When Tax time approaches, UltraCamp has several ways to send tax receipts to donors. You can choose to print receipts for mailing or email them to donors directly. For both methods, the process starts with creating a stored Donation Report.

Create a Donation Report

The first step in preparing donor tax receipts is to create a stored group that contains the information you’ll need for generating the receipts. A recommended way to do this is by running a Donations report. This can be done either under the Reports or Extra Services menu.

You can a donation report in one of two ways:

Option A: Reports Menu

-

- Go to Reports expand Financial.

- Click on Donations.

- Select the season or calendar date range that you want to pull donations for.

- Scroll to bottom and click Load Report.

- You should now be shown a results list that contains all of the donations made for the time frame you indicated in the report parameters.

- Save results as a stored group.

Option B: Extra Service Menu

-

- Go to Extra Services and expand Donor Management.

- Select Donation Reports.

- Select the season or calendar date range that you want to pull donations for.

- Scroll to bottom and click Load Report.

- You should now be shown a results list that contains all of the donations made for the time frame you indicated in the report parameters.

- Save results as a stored group.

Print Paper Receipts

-

- Create Donation Report and save as a stored group.

- Go to Tools and expand Stored Groups.

- Click on Printouts and select the Printout Template called Tax Receipt.

- From the dropdown menu, select the stored group that was just created in the Donations report.

- Select the appropriate Year.

- In most cases this would be the previous calendar year.

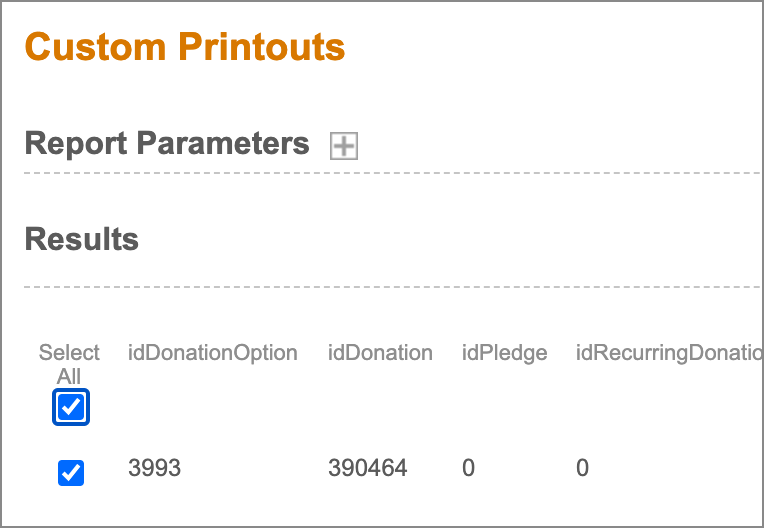

- Click Search to view the Custom Printouts results list.

- Check Select All in Custom Printouts (top box, far left column) to select the entire results list.

-

- Click the Print Selected button (bottom right).

- In the My Jobs page, you'll see the most recent job is your Printout - Tax Receipt.

- Its status may show as In progress. It's ready once the status shows as complete.

- Click on the Adobe Acrobat icon in the Access column to the right, you will now see the PDF with a page for each donor account.

- Print PDF, now you can mail one to each donor account’s primary contact.

Email Tax Receipts

If you prefer to email the tax receipts, you’ll first need to create a stored group that contains the information needed for the receipts. Follow the steps listed above to run a Donations report and store a saved group.

-

- Create Donation Report and save as a stored group.

- Go to Tools and expand Correspondence.

- Click on Email a Stored Group and select Email a Stored Group from options.

- Click Next.

- Select the stored group that you just created from your Donations report and click Next.

- From Send an Email, compose your email and click Next.

- Fill out the appropriate fields, clicking Next until you come to the list of attachments.

- Select Tax Receipt in the list of possible Attachments.

- Select the Year that you want to create your tax receipts for.

- In most cases this would be the previous calendar year.

- Click Save.

- Click Send Email.

- The email will go out with their Tax Receipt included as an attachment.

Comments

Please sign in to leave a comment.